Life insurance is a contract that you enter with your insurance company, which promises a certain amount to your beneficiary(ies) (nominies) in the event of your death. Premiums usually depend on your age, gender, occupation, medical history and other factors.

There are other types of life insurance that may provide benefits for you and for your family while you are still living. These policies can accrue a cash value on a tax-deferred basis and can be used for future needs such as retirement or your childs education.

Do I Need Life Insurance

Earning an income allows you and your family to do many things. It pays for your mortgage, buys cars, food, clothing, vacations and many other luxuries that you and your family enjoy. However, certain events can cause you to lose your income, and those who depend on you and on your income. If any of the following statements about you and your family are true, then it is probably a good idea for you to consider life insurance.

1) You are married and have a spouse.

2) You have children who are dependent on you.

3) You have a parent or relative who is aged or disabled and depends on you.

4) You have a loved one in your life that you wish to provide for.

5) Your retirement plan, pension, and savings arent enough to insure your loved ones future.

What Are Your Life Insurance Options?

There are two basic types of life insurance that can meet you and your familys needs:

Term Life Insurance

This is the least expensive type of life insurance coverage, and at least at the beginning, the simplest. Term life insurance policies do not accrue cash value and are fixed over an extended period of time.They can be renewed from time to time. This life insurance policy pays the beneficiary of the policy a fixed amount in the event of the insured persons death during the tenure of the policy period. The premiums for term life insurance are lowest when you are young and increase as you get older

Whole Life Insurance - endowment or money back or pension policies

This type of life insurance is similar to term life insurance but provides cash value as well. Over time, whole life insurance generally builds up a cash value on a tax-deferred basis, and pays its policyholders a bonus. This type of life insurance is popular, due to the cash value that is accessible to you or your beneficiaries before you die which can be used to supplement retirement funds, or to pay for your childs education, or provide a periodic cash flow over a period.Whole life insurance should be used for protection, rather than for accumulation.

If you have any querry..... We are available

Contact us

Eleanor Roosevelt

American politicianIn the long run, we shape our lives, and we shape ourselves. The process never ends until we die. And the choices we make are ultimately our own responsibility.

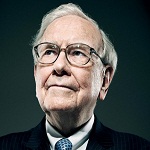

Warren Buffett

American investorI will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.

Walters

Chief JusticeTaxes are the lifeblood of government and no taxpayer should be permitted to escape the payment of his just share of the burden of contributing thereto.